The Micro, Small, and Medium Enterprise (MSME) sector forms the backbone of the Indian economy, contributing significantly to employment generation and economic growth. Recognizing its vital role, the Government of India established the National Small Industries Corporation (NSIC) to foster the growth and competitiveness of MSMEs. This article provides a comprehensive overview of the NSIC, its benefits, and the various schemes it offers to empower MSMEs in their journey towards success.

The National Small Industries Corporation (NSIC), established in 1955, is a Mini Ratna Government of India enterprise under the Ministry of Micro, Small and Medium Enterprises (MSME). It functions as a facilitator, promoter, and enabler for MSMEs in India. NSIC’s primary objective is to enhance the competitiveness of MSMEs by providing them with integrated support services encompassing marketing, technology, finance, and skill development. It acts as a bridge connecting MSMEs with potential markets, technologies, and financial resources, fostering their growth and sustainability.

This scheme enables MSMEs to participate in government tenders. Registered MSMEs are exempted from paying earnest money deposits (EMD) and are given preference in government procurement.

This scheme aims to enhance the marketing capabilities of MSMEs by providing support for participation in exhibitions, trade fairs, and other promotional events.

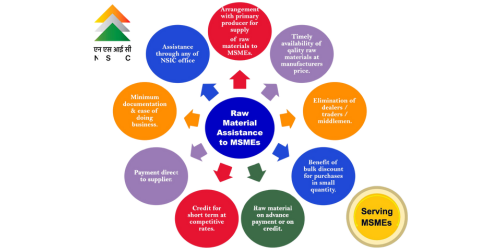

This scheme provides financial assistance to MSMEs for procuring raw materials, ensuring smooth production and timely delivery of goods.

NSIC facilitates access to credit for MSMEs by partnering with banks and financial institutions. This scheme helps MSMEs meet their working capital and term loan requirements.

This scheme helps MSMEs assess their strengths and weaknesses and improve their creditworthiness. A good credit rating can facilitate access to finance at competitive interest rates.

This scheme supports MSMEs in adopting modern technologies and equipment to improve their productivity and efficiency.

NSIC provides incubation facilities and support to new and innovative MSMEs, helping them nurture their ideas and develop viable businesses.

| Scheme | Objective | Key Benefits |

|---|---|---|

| Single Point Registration | Facilitate participation in government tenders | EMD exemption, free tender sets, procurement preference |

| Marketing Assistance | Enhance marketing capabilities | Support for exhibitions, trade fairs, and promotional events |

| Raw Material Assistance | Provide financial assistance for raw material procurement | Enables smooth production and timely delivery |

| Credit Facilitation | Facilitate access to credit from banks and financial institutions | Meets working capital and term loan requirements |

| Performance & Credit Rating | Assess strengths and weaknesses, improve creditworthiness | Access to finance at competitive interest rates |

| Technology Upgradation | Support adoption of modern technologies and equipment | Improves productivity and efficiency |

| Incubation | Provide facilities and support to new and innovative MSMEs | Nurtures ideas and develops viable businesses |

| Scheme | Objective | Key Benefits |

|---|---|---|

| Single Point Registration | Facilitate participation in government tenders | EMD exemption, free tender sets, procurement preference |

| Marketing Assistance | Enhance marketing capabilities | Support for exhibitions, trade fairs, and promotional events |

| Raw Material Assistance | Provide financial assistance for raw material procurement | Enables smooth production and timely delivery |

| Credit Facilitation | Facilitate access to credit from banks and financial institutions | Meets working capital and term loan requirements |

| Performance & Credit Rating | Assess strengths and weaknesses, improve creditworthiness | Access to finance at competitive interest rates |

| Technology Upgradation | Support adoption of modern technologies and equipment | Improves productivity and efficiency |

| Incubation | Provide facilities and support to new and innovative MSMEs | Nurtures ideas and develops viable businesses |

NSIC offers a wide range of integrated support services to empower Micro, Small, and Medium Enterprises (MSMEs). From marketing and financial aid to technology and skill development, these services are designed to enhance competitiveness, promote innovation, and ensure sustainable business growth both in domestic and international markets.

This comprehensive guide provides a solid foundation for understanding the benefits and schemes offered by NSIC, empowering MSMEs to leverage these resources for growth and success.